NZ companies looking for professional services can rely on the solutions offered by our team of accountants in New Zealand. We are one of the accounting firms in Auckland that can also provide services to companies located in other cities, such as Christchurch or Wellington. Together with our partner lawyers in New Zealand, we provide comprehensive solutions to both tax and legal matters.

| Quick Facts | |

|---|---|

| Bookkeeping services in New Zealand |

– accounts receivable and accounts payable management, – different bank account reconciling actions, – preparing the financial statements |

|

Payroll |

– calculating the wages, – making the wage payments, – making the needed contributions for social security purposes |

|

Invoicing |

– preparing and issuing invoices and proforma invoices, – tracking the issued invoices and overdue invoice reporting |

| Cash management |

Commonly included as part of accounting in New Zealand, this consists of managing the company’s cash flows . |

| Reporting |

Assistance for preparing the annual financial statements according to the type of company (especially for public companies). |

| Financial analysis |

Part of the accounting in New Zealand there are also operational efficiency evaluations, profitability ratio calculations and more. |

| Forensic accounting |

Accounting services as needed in investigations concerning fraud or money laundering investigations. |

| Tax compliance |

– corporate income tax filing and payment as needed, – ongoing compliance with other taxes for companies in order to avoid unnecessary penalties |

| VAT compliance and reporting |

– Goods and Services Tax (GST) registration for companies that are required to do this, – GST filing and reporting |

| Audit services offered by our accountants in New Zealand |

Filing the audited financial statements for companies that are subject to this requirement (most notably, subsidiary NZ companies and others) |

| Property financial matters |

– property tax compliance, – information on the taxes charged by local authorities in New Zealand |

| Statutory compliance |

Assistance for complete compliance with the principles for accounting in New Zealand, IFRS adoption and implementation. |

| Tax authority assistance |

Representation in front of the New Zealand Inland Revenue Department |

| Support for voluntary dissolution |

Assistance for settling the debts towards creditors, distributing the remaining assets to shareholders during the liquidation process |

| Services for foreign companies |

– information about foreign company taxation principles in NZ, – double taxation agreement implementation |

If you have specific questions about our services, a chartered accountant in New Zealand from our team can give you personalized answers.

Read below to find out more about how we can assist you in complete compliance with the current tax and corporate laws in NZ.

Services offered by our chartered accountants in Auckland

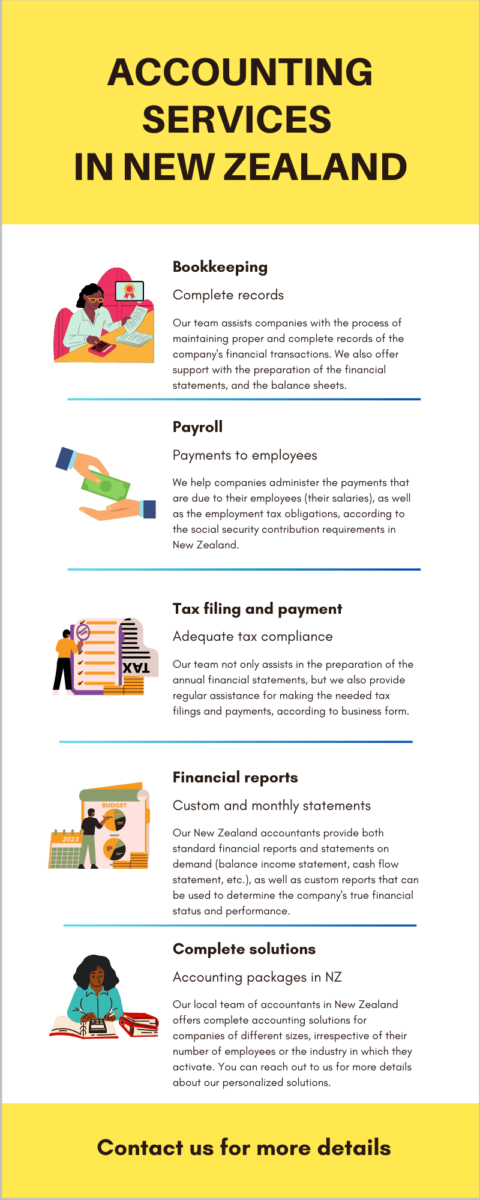

Many companies in New Zealand choose to outsource their accounting in order to benefit from cost savings, as well as timely and reliable services. We are one of the accounting firms in NZ that offer complete solutions to companies of all sizes, as well as across many different industries.

The packages and services provided by our accountants in New Zealand can be customized to meet the needs of the corporation, based on its number of employees.

In most cases, we work on an hourly basis, meaning that small companies, for which the processes handled by our chartered accountants in Auckland take less time, will pay less for their annual accounting.

If you are in need of services for accounting in New Zealand, we can help you with the following:

- Bookkeeping: processing payments, invoices, cashflow management, reconciling bank and credit card accounts, etc.;

- Payroll: handling all matters concerning the payment of your employees’ salaries, calculating the hours and additional time worked, bonuses, payroll expense management and relevant submissions;

- End-of-year accounts: a core part of our services for accounting in New Zealand is the preparation of the final profit and loss account, the balance sheet and other documents for the end of the financial year;

- Support: our team offers ongoing support to our clients; we also help start-ups with relevant information about the applicable taxation principles.

Working with one of the accounting firms in Auckland that have extensive experience, such as our own, can be an important business advantage.

If you are in need of services related to company formation or legal solutions for matters concerning corporate and business law, our lawyers in New Zealand can answer your questions.

NZ reporting requirements outlined by our accountants in New Zealand

The accounting standards are issued by the New Zealand Accounting Standards Board. Companies are subject to different financial reporting standard based on their revenue or assets:

- Minimum financial reports: prepared only by companies that, during the last 2 accounting years have had either a total income of $30 million or less or have assets that are $60 million or less;

- Higher standard financial accounts: they have had an annual revenue above $30 million or assets of more than $60 million in the last 2 accounting years; these higher standards also apply to those companies with ten or more shareholders and in other situations;

- Reporting exemption: small companies do not prepare the financial statements if, during the tax year, they had an income of less than $30,000 or had not incurred expenditure of more than $30,000;

- Audit: generally applicable to large companies; most accounting firms in NZ also offer audit services upon request; you can reach out to us if you need auditing solutions.

A chartered accountant in New Zealand from our team can give you more details about the principles outlined above. We also invite you to watch a short video on this topic:

Taxation in New Zealand

Understanding the tax and reporting principles is a key step for investors who decide to open a business in New Zealand.

The company director is liable for the manner in which the corporation complies with many of the laws and regulations, therefore, it is in the best interests of the company’s founders to remain up to date with the tax and reporting requirements.

Additionally, late filing or incomplete/inaccurate filing, as well as false statements, result in penalties.

Our accountants in New Zealand highlight the main taxes for companies below:

- corporate income tax rate: 28%; the same rate applies to branches in New Zealand;

- dividend withholding tax: 0%-33% for residents and 0%, 15%, 30% in case of nonresidents, subject to the double taxation agreements in force;

- goods and services tax: the NZ equivalent of the value added tax has a standard rate of 15% and a reduced rate of 0%;

- 3% of the employee’s gross pay is the minimum employer’s contribution to the KiwiSaver;

- there is no payroll tax, transfer tax, stamp duty or capital duty;

- the employer is also subject to fringe benefits tax on these types of benefits offered to its employees.

Generally, losses can be carried forward indefinitely, with a 49% continuity requirement for the ultimate share ownership. Losses can be offset against the profits of other group companies, subject to conditions.

Businesses can access foreign tax credit against New Zealand income tax, which applies to foreign income. However, the credit is limited to the lesser value of the effective foreign tax paid on the foreign income.

Companies operating in the research and development sector benefit from a tax incentive scheme allowing them to access a 15% tax credit for eligible expenditure.

This can be an important advantage for R&D companies and, as needed, our accountants in New Zealand can provide investors with information on how they can access this scheme. If considered eligible they will access a minimum amount of spending of NZD 50,000, with the total possible amount capped at NZD 120 million.

Other concessions and rules can apply in selected industries, such as farming or forestry, as well as film production.

You can also reach out to our accountants in New Zealand if you need information or clarification on the relevant tax laws from our attorneys.

Reasons to work with a chartered accountant in New Zealand

Companies of all sizes, and across all industries, benefit from choosing to work with a team of accountants.

Outsourcing the accounting services is a common practice, given the fact that not all companies have the possibility to have an internal accounting department.

We are one of the accounting firms in New Zealand specializing in working with companies that outsource these types of services.

Our collaborative team can provide the needed financial solutions, as well as assistance and counsel, from the earliest stages.

For companies that are already on the market, and need a fresh perspective on their financial status, we are able to provide complete financial analyses and risk analysis.

Some of the main reasons for working with our team include the following:

- you will save time: our team will focus on financial compliance while you focus on growing your business;

- lower costs: in most cases, from a financial point of view, it is more convenient to outsource accounting than to hire and internal team to handle the needed operations;

- accurate reporting: when you choose to work with an experienced team, you can rest assured that your financial reports will be accurate and drawn up in compliance with the laws in force;

- expert advice: as we have previously said, we do not only provide accounting services, but also expert advice and analysis.

Your business will be better able to expand when your financial matters are under control and when you know where you stand in terms of revenue, expenses and other key performance indicators.

Your company is in good hands when working with our team.

Contact our accountants in New Zealand for more information about our services.